Must Reads

There is so much to read, so much to know, so many sources to follow. And the volume of news and information just keeps growing exponentially. How to keep up? Even more, how to rediscover the serendipity of learning something new and interesting for its own sake?

Here, for your enjoyment and interest, are the articles Temin and Company considers “must reads.” They are primarily on the topics of reputation and crisis management, the media, leadership and strategy, perception and psychology, self-presentation, science, girls and women, organizational behavior and other articles of interest.

They are listed below with the most recent articles first, and to the side, by category.

We hope you enjoy them and would appreciate your comments. And whenever you have any favorite articles for us to add, please let us know so that we might include them for other readers to enjoy.

There is so much to read, so much to know, so many sources to follow. And the volume of news and information just keeps growing exponentially. How to keep up? Even more, how to rediscover the serendipity of learning something new and interesting for its own sake?

Here, for your enjoyment and interest, are the articles Temin and Company considers “must reads.” They are primarily on the topics of reputation and crisis management, the media, leadership and strategy, perception and psychology, self-presentation, science, girls and women, organizational behavior and other articles of interest.

They are listed below with the most recent articles first, and to the side, by category.

We hope you enjoy them and would appreciate your comments. And whenever you have any favorite articles for us to add, please let us know so that we might include them for other readers to enjoy.

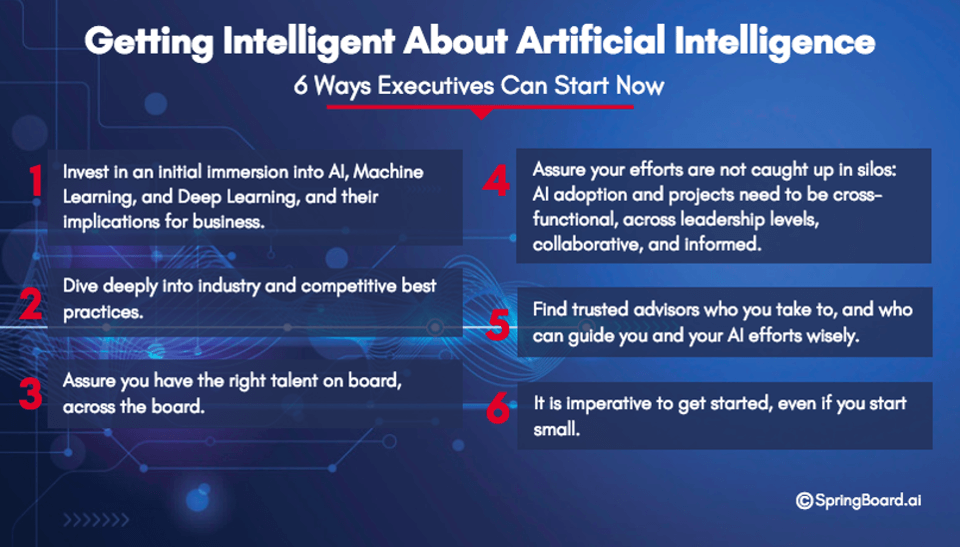

Getting Intelligent About Artificial Intelligence: 6 Ways Executives Can Start

Davia Temin, Bruce Molloy, Jayanth Kolla, Leadership, “Reputation Matters,” Forbes, December 8, 2017

This past June, Fortune Magazine asked all the CEOs of the Fortune 500 what they believed the biggest challenge facing their companies was. Their biggest concern for 2017: “The rapid pace of technological change” said 73% of those polled, up from 64% in 2016. Cyber security came in only a far second, at 61%, even after all the mega hacks of the past year.

So, what does “technological change” entail? For almost all Fortune 500 CEOs, it means, in part, artificial intelligence. And, as we wrote in our piece yesterday on Forbes.com, “Forget The Hype: What Every Business Leader Needs To Know About Artificial Intelligence Now,” AI is on the lips of almost every global CEO and Board of Directors.

But apart from the Big 8 technology companies – Google, Facebook, Microsoft, Amazon, IBM, Baidu, Tencent, and Alibaba – business leaders, especially of earlier generations, may feel they don’t know enough about AI to make informed decisions.

We made a series of 6 suggestions of how board members and C-suite executives can begin to understand this brave new world of AI, Machine Learning, and Deep Learning. And, after being asked by a number of people to break that list out for them, we include it, slightly modified, here. […read more]

Forget The Hype: What Every Business Leader Needs To Know About Artificial Intelligence Now

Davia Temin, Bruce Molloy, Jayanth Kolla, Leadership, “Reputation Matters,” Forbes, December 6, 2017

Artificial Intelligence – it’s on the lips of the leaders, and on the 2018 agendas of the board meetings, of almost every global company today. Directors and operating executives alike know, or think they know, that this “new electricity” is going to be the next transformative force of our world. To ignore it now could be fatal to their long-term competitive position, not to mention survival.

AI-powered companies that know what they are doing — primarily born in the Internet and mobile eras — have not only gained tremendous advantage in improved efficiency and increased profitability, they have literally changed the competitive landscape of successive industries. And they are continuing to do so, as they venture into new fields, challenging a whole new set of incumbents that are not AI “natives.” (Witness Google’s Launchpad Studio’s focus on healthcare AI startups, and Alphabet’s Waymo autonomous cars, to name only two.) […read more]

Met Opera Grapples With Sex Accusations Amid Financial Challenges

Jennifer Smith, The Wall Street Journal, December 4, 2017

The Metropolitan Opera already was struggling to get its financial house in order when the bombshell hit: Multiple allegations of sexual abuse by famed conductor James Levine, who served as the company’s music director for four decades.

Those accusations, which led the Met this past weekend to suspend its relationship with Mr. Levine and launch an internal probe, could complicate its funding woes.

“The right road is to get ahead of it,” said Davia Temin, chief executive of Temin and Company Inc., a reputation and crisis-management consultancy. “You have to demonstrate, from the time you start hearing of a report…that you are taking the moral high ground.” […read more]

NBC Fires Matt Lauer for “Inappropriate Behavior”

Richard Quest, Quest Means Business, CNN Money, November 29, 2017

U.S. TV anchor, Matt Lauer, was fired by NBC news after a complaint about inappropriate sexual behavior in the workplace.

Forget the drawn-out Harvey Weinstein or Kevin Spacey. With Matt Lauer, it all happened very quickly. The complaint was filed against Lauer on Monday. The investigation took place on Tuesday. And he was fired last night. The speed shows how seriously companies are now taking sexual harassment claims.

“It’s about time. Finally…through some conglomeration of social media, more women around, finally it is being taken seriously, and not a wink, wink, nod, nod,” said Davia Temin.

“I think that you can probably assume from the quickness with which Matt Lauer was fired that there was some real proof there. We don’t know what they saw. They’re not sharing everything. It’s not total transparency. Nor should it be. But there’s probably an awful lot of proof there. So, what I would say to you is, it’s not time yet. It’s not time for the pushback when we’re still just starting to hear what the real problem is.”

“All I can say is, it’s about time that they start looking the right way now. Let’s not castigate them for that yet.” […read more]

Managing Crisis in an Era of Disruption

Business for America, November 16, 2017

As a crisis strategist, Davia Temin deals with the thorniest issues of the day, from global politics and instability, to corporate board and C-suite priorities and intrigue, to the crises faced by our nation’s top colleges and universities. She often shares her insights as a Forbes.com columnist on “Reputation Matters.” On the call with Business for America (formerly DisruptDC), she discussed all these topics and answered questions about how to lead with integrity and efficacy through whatever crisis comes your way. […read more]

Halperin Scandal Adds to List of Harassment Concerns

Richard Quest, Quest Means Business, CNN Money, October 26, 2017

Five women have come forward with harassment claims against the journalist, Mark Halperin, relating to his time at ABC news. Halperin says he’s now stepping back from his role at MSNBC and NBC news. And while he denies some of the allegations, he does say he’s deeply sorry.

What is a company supposed to do when there are people like President H. W. Bush, who believed it was OK to pat a woman’s posterior. You’ve got Halperin, who asked people out on dates and then tried to kiss them, allegedly. Where are we going with this?

“Well, I think from time immemorial, we’re going to something that has been almost always true. And we’ re reaching a tipping point right now where it’s no longer acceptable. People are starting to talk about it more. Women are telling their stories more. And it starts with one person’ s personal narrative.”

But the company itself…what is the company supposed to do?

“First of all, they’ve already got the stuff on the books. They’ve got their regulations on the books. They haven’t ever enforced them in the way that most women would like to see it. So, what can companies, if the companies are getting serious about this, because of social media, because of 24-hour news shows, what now they need to do are carrots, sticks, and nudges. This is to change behavior. Carrots, sticks, nudges.” […read more]

To watch the interview, CLICK HERE.

Johnson Makes Rare Speech as Fidelity Deals With Harassment

Charles Stein, Laura Colby and Miles Weiss, Bloomberg, October 24, 2017

Fidelity Investments’ Abigail Johnson took center stage on Tuesday and counseled money managers gathering in Washington about charting their future in the digital world. But the chief executive, a featured speaker at one of the industry’s biggest conferences, is also struggling with a stubborn legacy of the past: the treatment of women in the world of finance.

Over the last two months, Fidelity, one of the largest investment companies, has dismissed two portfolio managers — one over allegations of inappropriate sexual comments and another over claims of sexually harassing a female junior employee.

Fidelity and other money managers may face a flood of complaints “now that the lid is off,” said Davia Temin, president and CEO of Temin & Co., a New York based crisis-management company.

Going forward, Johnson has to continue to “set the tone” that the organization will take every case that comes to light seriously and emphasize there’s also a business case for doing so, said Temin. While Fidelity is a closely held company without public shareholders, its customer base cares about these issues, she said. Some public pension funds already demand that women be included on teams that manage their money. […read more]

How Boards Should Handle a CEO Scandal

Chief Executive, October 24, 2017

It used to be that a founding CEO could be excused all manner of misbehavior by his or her board, as long as it was kept quiet and the bottom line was not negatively impacted. In my 20 years as founder and CEO of a boutique crisis management firm, I have dealt with well over 60 cases of CEO dismissal, and an equal number of case where the CEO did not get dismissed. It used to be that the board might either tolerate bad behavior, or publicly support a CEO while privately chastising him relentlessly. Regardless, he or she would stay.

More recently, however, given the outsized attention to serious CEO misbehavior, boards really have little choice—they must react, and act, quickly and decisively. In the brave new world of 24-hour news cycles and social media commentary that transits the globe at the speed of light, no CEO is invulnerable or—once found to be guilty of ethical violations—irreplaceable.

Boards need to keep ahead of the public humiliation and loss of reputational equity caused by major CEO misbehavior or malfeasance. If they deny, or stall, they run the risk of ruining their company and turning themselves into the targets of shareholders’ and the public’s bloodlust. […read more]

Faber, Weinstein Put Boards on Notice: You’re the Adults Now

Jeff Green and Jordyn Holman, Bloomberg, October 17, 2017

Corporate directors should now be on notice: bad behavior isn’t so easily swept under the rug. As a parade of executives has been outed as sexist, racist or both, boards have been called on to set — and enforce — standards of decent behavior.

On Tuesday, veteran investor and ubiquitous pundit Marc Faber agreed to leave the boards of three companies after he published racist commentary in his subscription newsletter. The week before, five Weinstein Co. directors quit in the wake of revelations about Harvey Weinstein and his history of alleged sexual assault and harassment made public by the New York Times and the New Yorker.

At this point, “CEOs and boards have to be the adults in the room,” said Davia Temin, head of the New York-based crisis-management firm Temin & Co. “Boards’ voices are getting strengthened, to some degree, because of the need of a counterpoint.” […read more]

How to Handle a PR Crisis a Lot Better Than Equifax

Leigh Anderson, Lifehacker, September 21, 2017

The Equifax data breach, in which 143 million accounts were compromised and which might have years-long consequences for consumers, was historic in its scope and potential for damage. But it’s also notable for how extraordinarily badly the company, at least from a public-relations standpoint, handled the fallout.

“It was a model of the worst case imaginable,” says Davia Temin, president and CEO of Temin and Company, a crisis and reputation-management firm. If you’re running a business, crises are inevitable.

It’s how you handle them that will determine whether you’ll move on relatively unscathed—or whether you’ll lose customers or even be forced out of business entirely. In this article, the author spoke to a couple of experts in the field about how they would have handled the Equifax breach better. […read more]